A rate shopper is a tool that automatically checks the prices of selected hotels for a given date.

NB: This is an article from HowsMyRate, one of our Expert Partners

The user can choose which source they would like to have their prices taken from, and select the date span and number of hotels to check. This gives a detailed overview of the market and rates state at the given moment.

Subscribe to our weekly newsletter and stay up to date

In every market, competitive price information is critical for making day-to-day business decisions – a small, barely noticeable price increase can generate significant revenue benefits when one takes into consideration the overall yearly scale. Meanwhile, missing an insight on competition and having prices that are too low can affect your demand.

The power of increasing prices and scale

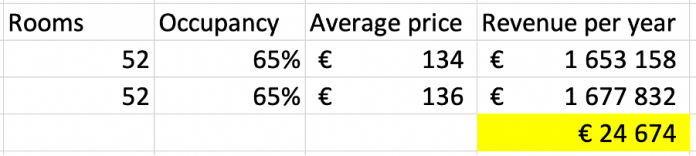

It’s important to understand how these actions can bring actual tangible results in one’s revenue management. Let’s look at this example: here we have a small hotel with 52 rooms, 65% occupancy and an average price of 134 € . In this case, a small increase in price by a mere 2 € would benefit the yearly revenue by the sum of 24 674 €.

Many hoteliers tend to underestimate the power of increasing prices and scale. Why? Many consider applying price changes only several times per year only, those being significant changes, that affect the demand and competition. While the trick to success is to be able to increase the price when not noticeable (without impacting the demand or competition) as often as one can. You can read about it in more detail in one of our latest articles.

To be able to do that, competition price intelligence (delivered by rate shopping tools) is needed to understand when the best moment is to increase the price and by how much. This is a good strategy for longer-term benefits.

Rate Shopper’s benefit of the application of variable costs

Rate shoppers help hoteliers to act on price upon costs. When a hotel has established its’ variable costs per room (costs that occur when a room is sold), it can lower the price to save on costs.

Let’s look at another example: a hotel room’s price is 80 € and they have established their variable cost per room to be 20 €. The hotel possesses a fixed cost (costs that occur regardless of if the room was sold or not) of 40 €. So when the hotel sells a room, it generates 80 € in revenue. However, because of the costs of 20 € and 40 €, the profit for that room is 20 €. However, when the hotel does not sell the room, it does not have any revenue, just the fixed cost of that room, so it results in 40 €.

In every rational market, demand observes price-sensitive segments – demand that would buy a product if the price was lower. So now, the hotel needs to answer a question – if they lower the price, would they sell an empty room that costs them 40 € every night? And then how low they can go with the price.

The answer to the first question is simple: the hotel will not know until it tries.

The answer to the second question is twofold: long-term and short-term.

From a long-term perspective, the average price hotel sells should be anything but higher than costs. So the minimum price in our example should be higher than 60 €. The price of 60 € is a break-even price.

But in a short-term perspective – the situation may require the hotel, to drop the price to decrease the costs.

To demonstrate it in the most understandable way, take a look at this example:

In line 1, there is a scenario where one sells the room at a given price of 80 €. That way there is a profit of 20 €.

In line 2, there is a scenario where one does not sell a room at all, the loss being 40 €. Every unsold room is a cost and a revenue loss. On a scale of a year, the loss is significant.

But if the market is price sensitive, it is likely that dropping the price below the costs can sell the room. What happens then?

In line 3, there is a sale of the room below the break-even point for 50 €. The revenue is 50 €, the cost is 60 €, and the loss results in minus 10 €, which is four times lower than the loss from not selling the room.

And so it goes in lines 4,5,6 to show how dropping the price of an un-sold room can decrease the loss when sold for that price.

This action is good only for short-term perspectives, but again, requires a rate shopper to identify competition prices and understand what price is low enough to generate demand or which price will dump competition as in too low price.

Read more articles from HowsMyRate

The post Application of a Variable Pricing Strategy Based on Rate Shopper Data appeared first on Revenue Hub.